The eurozone crisis worsened yesterday, when Standard & Poor cut Spain's credit rating after downgrading both Greece and Portugal.

Meanwhile the estimate as to how much Greece needs from the IMF/EU has risen to Euro 120BN.

The only way out of this mess now is for Greece to leave the Euro ASAP.

Loans and Finance

Loans and Finance

Text

News and information about loans, money, debt, finance and business issues.

Powered by Investing.com

Thursday, April 29, 2010

Wednesday, April 28, 2010

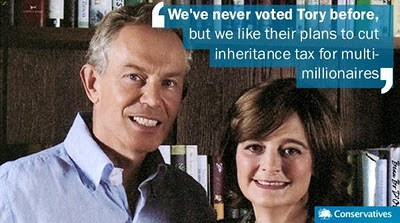

Stephanopoulos and Son

S&P has cut Greece's credit rating to junk status, thus bringing to a head the ongoing the crisis that has been brewing for months.

Juergen Stark, European Central Bank Executive Board member, has warned that the current trend is not sustainable:

"The current trend in fiscal policies is simply not sustainable. ... The onus is now on governments to ensure that the crisis that initially affected the financial sector, and subsequently the real economy, does not lead to a full-blown sovereign debt crisis.

Averting it will require very ambitious and credible fiscal consolidation efforts. In fact, substantially stronger consolidation efforts than those conceived so far."

S&P also went on to cut Portugal's rating by two notches to A-. Thus upping the ante on the Eurozone governments to resolve this crisis one way or another.

Greek regulators have announced a ban on short-selling on Greece's stock market, following steep falls (9%) in bank shares.

Asian and European markets have fallen sharply, as it is clear that the Eurozone has yet to satisfactorily address this issue.

It is clear that the only solution (for both the Eurozone and Greece) is for Greece to leave the Euro and refloat the Drachma.

The longer this decision is put off, as a result of political posturing and fake "machismo", the greater the pain will be for both Greece and the Eurozone.

The Eurozone and Greece need to get real!

Juergen Stark, European Central Bank Executive Board member, has warned that the current trend is not sustainable:

"The current trend in fiscal policies is simply not sustainable. ... The onus is now on governments to ensure that the crisis that initially affected the financial sector, and subsequently the real economy, does not lead to a full-blown sovereign debt crisis.

Averting it will require very ambitious and credible fiscal consolidation efforts. In fact, substantially stronger consolidation efforts than those conceived so far."

S&P also went on to cut Portugal's rating by two notches to A-. Thus upping the ante on the Eurozone governments to resolve this crisis one way or another.

Greek regulators have announced a ban on short-selling on Greece's stock market, following steep falls (9%) in bank shares.

Asian and European markets have fallen sharply, as it is clear that the Eurozone has yet to satisfactorily address this issue.

It is clear that the only solution (for both the Eurozone and Greece) is for Greece to leave the Euro and refloat the Drachma.

The longer this decision is put off, as a result of political posturing and fake "machismo", the greater the pain will be for both Greece and the Eurozone.

The Eurozone and Greece need to get real!

Tuesday, April 27, 2010

Return To The Drachma

The Greek tragedy continues apace.

Angela Merkel, the German Chancellor, had to make an emergency statement yesterday "promising" aid to Greece in response to the continued pressure brought to bear by the markets.

However, her politician's promise (which contained a pre condition) failed to mollify the markets who suspect that Greece will not be able to restructure its economy nor meet its debt obligations (even if Germany does finally agree to the bailout plan).

The interest rate on two year Greek debt rose to almost 14% yesterday, in response to rumours that Greece was seeking an emergency restructuring of its short-term borrowings.

The trouble with financial rumours is that they have a habit of becoming self fulfilling, especially during financial tsunamis; ie the increase in rates, brought about by the rumour, will force Greece to restructure its debt obligations.

Angela Merkel's statement contained a hidden threat which can be easily understood by anyone:

"I say quite clearly, Germany will help, if the corresponding pre-conditions are met."

She added:

"If Greece is prepared to accept tough measures — and not just for one year but for several years — then we have a good chance to keep and secure the euro as a stable currency for us all."

The domestic reality for Greece is that it simply cannot enact the tough measures demanded of it by the Eurozone.

The only viable solution for the Eurozone and Greece is for it to leave the Euro, and return to the Drachma.

Angela Merkel, the German Chancellor, had to make an emergency statement yesterday "promising" aid to Greece in response to the continued pressure brought to bear by the markets.

However, her politician's promise (which contained a pre condition) failed to mollify the markets who suspect that Greece will not be able to restructure its economy nor meet its debt obligations (even if Germany does finally agree to the bailout plan).

The interest rate on two year Greek debt rose to almost 14% yesterday, in response to rumours that Greece was seeking an emergency restructuring of its short-term borrowings.

The trouble with financial rumours is that they have a habit of becoming self fulfilling, especially during financial tsunamis; ie the increase in rates, brought about by the rumour, will force Greece to restructure its debt obligations.

Angela Merkel's statement contained a hidden threat which can be easily understood by anyone:

"I say quite clearly, Germany will help, if the corresponding pre-conditions are met."

She added:

"If Greece is prepared to accept tough measures — and not just for one year but for several years — then we have a good chance to keep and secure the euro as a stable currency for us all."

The domestic reality for Greece is that it simply cannot enact the tough measures demanded of it by the Eurozone.

The only viable solution for the Eurozone and Greece is for it to leave the Euro, and return to the Drachma.

Monday, April 26, 2010

Greek Crisis Worsens

It seems that Greece's hopes for a temporary respite from the financial tsunami currently engulfing its economy have been a little premature. Despite being "promised" a bailout package by the IMF/EU, and despite finally asking for bailout aid, it seems that Greece may not yet receive this aid.

For why?

Germany is insisting that Greece commits to wholesale economic reform (which will inflict more pain domestically).

Germany's finance minister Wolfgang Schauble has told a German newspaper that a decision on aid had not yet been made, and could yet be "negative".

The aid package will need to be ratified by the German parliament, and there are legal challenges in the offing.

In brief, the "promise" of aid was intended to provide a sop to the markets. It was never intended that the aid be actually paid out.

Unfortunately for the optimists in the EU, the markets are not so naive and know full well that the aid package was over hyped and that Greece has no intention (nor any domestic political power) to enact the powerful financial reforms necessary to placate the Germans. The markets are savaging the Greek economy, and pushing interest rates to unbearable levels.

The only viable solution for Greece, and indeed the Eurozone, as I have long argued is for Greece to leave the Euro.

Sadly for the Greek people, the country will not voluntarily leave the Euro and will be forced out by the markets. The pain that Greece is suffering will, in the short term, become far worse.

For why?

Germany is insisting that Greece commits to wholesale economic reform (which will inflict more pain domestically).

Germany's finance minister Wolfgang Schauble has told a German newspaper that a decision on aid had not yet been made, and could yet be "negative".

The aid package will need to be ratified by the German parliament, and there are legal challenges in the offing.

In brief, the "promise" of aid was intended to provide a sop to the markets. It was never intended that the aid be actually paid out.

Unfortunately for the optimists in the EU, the markets are not so naive and know full well that the aid package was over hyped and that Greece has no intention (nor any domestic political power) to enact the powerful financial reforms necessary to placate the Germans. The markets are savaging the Greek economy, and pushing interest rates to unbearable levels.

The only viable solution for Greece, and indeed the Eurozone, as I have long argued is for Greece to leave the Euro.

Sadly for the Greek people, the country will not voluntarily leave the Euro and will be forced out by the markets. The pain that Greece is suffering will, in the short term, become far worse.

Labels:

bailout,

EU,

euro,

fraud,

germany,

greece,

IMF,

interest rates,

recession,

wolfgang schaeuble

Friday, April 23, 2010

Greek Bailout

CNBC report that Greece is expected to formally ask to use the IMF/EU bailout package this morning.

This being the package that Greece has spent the last few weeks/days assiduously denying that it needs to use.

Given Greece's inability to put its financial house in order it is clear that the money alone will not be enough, and that Greece will eventually be forced out of the Euro.

This being the package that Greece has spent the last few weeks/days assiduously denying that it needs to use.

Given Greece's inability to put its financial house in order it is clear that the money alone will not be enough, and that Greece will eventually be forced out of the Euro.

Thursday, April 22, 2010

Greek Contagion Fears

Greece's attempts to renegotiate the terms of its IMF/EU bailout package has seriously spooked the markets, forcing interest rates on Greek debt up.

The attempt at renegotiation has also spooked the IMF and Bundesbank, who both warn that there is a serious risk of contagion spreading from Greece to other Eurozone countries unless matters are not addressed with some urgency.

The Telegraph quotes from the IMF's World Economic Outlook:

"In the near term, the main risk is that – if left unchecked – market concerns about sovereign liquidity and solvency in Greece could turn into a full-blown sovereign debt crisis, leading to some contagion."

Axel Weber, CEO of the Bundesbank, is also quoted saying that there is a:

"significant risk of contagion effects. A possible default by Greece would most likely be a severe economic blow for other countries in monetary union".

Those politicians in the UK who claim that it would be beneficial for the UK to join the Eurozone may care to watch the unfolding car crash of the Greek financial system, before making nay further pro Euro pronouncements.

The attempt at renegotiation has also spooked the IMF and Bundesbank, who both warn that there is a serious risk of contagion spreading from Greece to other Eurozone countries unless matters are not addressed with some urgency.

The Telegraph quotes from the IMF's World Economic Outlook:

"In the near term, the main risk is that – if left unchecked – market concerns about sovereign liquidity and solvency in Greece could turn into a full-blown sovereign debt crisis, leading to some contagion."

Axel Weber, CEO of the Bundesbank, is also quoted saying that there is a:

"significant risk of contagion effects. A possible default by Greece would most likely be a severe economic blow for other countries in monetary union".

Those politicians in the UK who claim that it would be beneficial for the UK to join the Eurozone may care to watch the unfolding car crash of the Greek financial system, before making nay further pro Euro pronouncements.

Wednesday, April 21, 2010

Greek Discussions

Greece has begun renegotiations with with the European Commission and International Monetary Fund (IMF) over the terms of the bailout package.

Greece issued the following statement yesterday:

"The discussions concern a three-year programme of economic policies... which can be supported with financial assistance from eurozone members and the International Monetary Fund should Greek authorities decide to request the activation of the mechanism."

Although the Greeks continue to deny that they will use the bailout, only the very naive could possibly believe that they will not use it. Interest rates for Greek debt have soared, and the latest estimates indicate that Greece will need up to Euro 80BN.

The renegotiations are expected to last 10 days.

Greece issued the following statement yesterday:

"The discussions concern a three-year programme of economic policies... which can be supported with financial assistance from eurozone members and the International Monetary Fund should Greek authorities decide to request the activation of the mechanism."

Although the Greeks continue to deny that they will use the bailout, only the very naive could possibly believe that they will not use it. Interest rates for Greek debt have soared, and the latest estimates indicate that Greece will need up to Euro 80BN.

The renegotiations are expected to last 10 days.

Tuesday, April 20, 2010

Friday, April 16, 2010

Greece Undermines Its Own Position

Greece, despite claiming that it does not need the bailout package offered by the IMF/EU, has requested talks with the European Union, European Central Bank and IMF to discuss the package.

In other words, it doesn't like the conditions attached (were it to take the package) and wants them softened, so that it can then take the package.

Unsurprisingly the markets have been unimpressed by this, and the Euro has fallen as a result whilst the cost to Greece of borrowing has risen.

All in all the Greeks continue to be authors of their own financial destruction.

In other words, it doesn't like the conditions attached (were it to take the package) and wants them softened, so that it can then take the package.

Unsurprisingly the markets have been unimpressed by this, and the Euro has fallen as a result whilst the cost to Greece of borrowing has risen.

All in all the Greeks continue to be authors of their own financial destruction.

Thursday, April 15, 2010

Markets Call Greece's Bluff

Unsurprisingly the markets are highly skeptical of Greece's commitment to restoring its shattered economy, and the efficacy of the EU/IMF bailout pledge.

As such the interest rates on Greek debts is soaring.

The key issue wrt the much hyped bailout, is that it is only a pledge. The paperwork has not been signed, and there is every reason to suppose that at least one Eurozone country will veto it.

In fact a quartet of German academics is putting its money where its mouth is, and is mounting a legal challenge to the bailout.

The group will ask for an injunction to block the transfer of German funds, until the court has ruled. It contends that the European Central Bank has broken EU law by bending collateral rules to help Greece.

Germany's Handelsbatt newspaper has cited sources warning that the bill for the bailout may be three times as high as thought, making the EU share €90BN.

The legal challenge will hold up the bailout package for months, thus undermining any confidence that the markets may have had in the package.

Dr Karl Albrecht Schachtschneider, law professor at Nuremberg and author of the complaint, has told The Daily Telegraph that he will be ready to file within days and will ask the court for an expedited procedure.

There is a sting in the tail, according to Hans Redeker, currency chief at BNP Paribas, speaking to the Telegraph:

"It could lead to Germany itself being catapulted out of the currency union. Once investors begin to fear this, there will not be single euro in further financing for the EMU periphery."

The quartet recognises the fundamental truth (the "elephant in the room" if you will) of the situation. Taking on more debt will not solve the problem, it merely puts off the day of reckoning. The inevitable solution that Greece needs to enact is to leave the Euro, and to allow its currency to fall.

At some stage or another this will occur. The longer it takes Greece to bite the bullet, the harder the pain will be when they do leave the Eurozone.

Ironically, to make matters worse, Greece intends to enact legislation that will bite the hand the feeds it. It will implement a 20% tax on villa extension.

Who, aside from the British, have the most villa extensions in Greece?

Oh, that would be the Germans!

As such the interest rates on Greek debts is soaring.

The key issue wrt the much hyped bailout, is that it is only a pledge. The paperwork has not been signed, and there is every reason to suppose that at least one Eurozone country will veto it.

In fact a quartet of German academics is putting its money where its mouth is, and is mounting a legal challenge to the bailout.

The group will ask for an injunction to block the transfer of German funds, until the court has ruled. It contends that the European Central Bank has broken EU law by bending collateral rules to help Greece.

Germany's Handelsbatt newspaper has cited sources warning that the bill for the bailout may be three times as high as thought, making the EU share €90BN.

The legal challenge will hold up the bailout package for months, thus undermining any confidence that the markets may have had in the package.

Dr Karl Albrecht Schachtschneider, law professor at Nuremberg and author of the complaint, has told The Daily Telegraph that he will be ready to file within days and will ask the court for an expedited procedure.

There is a sting in the tail, according to Hans Redeker, currency chief at BNP Paribas, speaking to the Telegraph:

"It could lead to Germany itself being catapulted out of the currency union. Once investors begin to fear this, there will not be single euro in further financing for the EMU periphery."

The quartet recognises the fundamental truth (the "elephant in the room" if you will) of the situation. Taking on more debt will not solve the problem, it merely puts off the day of reckoning. The inevitable solution that Greece needs to enact is to leave the Euro, and to allow its currency to fall.

At some stage or another this will occur. The longer it takes Greece to bite the bullet, the harder the pain will be when they do leave the Eurozone.

Ironically, to make matters worse, Greece intends to enact legislation that will bite the hand the feeds it. It will implement a 20% tax on villa extension.

Who, aside from the British, have the most villa extensions in Greece?

Oh, that would be the Germans!

Wednesday, April 14, 2010

Brown Admits He Made Mistake

I see Brown admitted this morning that he made a mistake re bank regulation.

I think I need to sit down!

I think I need to sit down!

Tuesday, April 13, 2010

T Day

The market's belief in the Greek government's commitment to financial reform, will be tested today when Greece issues Euro 1.2BN of treasury bills.

Greece needs to raise Euro 11BN by the end of May in order to refinance maturing debt and interest charges. In total, for 2010, it needs to borrow Euro 53BN.

The bailout is in effect merely a "promise" to offer help if Greece asks for it. The hope being that by offering the bailout markets will be suitably reassured, and Greece can then be able to borrow money from the market via bond sales rather than activating the bailout package.

Were Greece to ask for the package to be activated there is a high risk that individual Eurozone states may veto it, or that it simply will not be enough.

The markets, Greece and the EU will be watching very closely how T Day goes.

Greece needs to raise Euro 11BN by the end of May in order to refinance maturing debt and interest charges. In total, for 2010, it needs to borrow Euro 53BN.

The bailout is in effect merely a "promise" to offer help if Greece asks for it. The hope being that by offering the bailout markets will be suitably reassured, and Greece can then be able to borrow money from the market via bond sales rather than activating the bailout package.

Were Greece to ask for the package to be activated there is a high risk that individual Eurozone states may veto it, or that it simply will not be enough.

The markets, Greece and the EU will be watching very closely how T Day goes.

Monday, April 12, 2010

Dead Cat Bounce

The Euro "enjoyed" something of a dead cat bounce today, as markets temporarily offered it respite after the announcement of the Euro30BN and the International Monetary Fund Euro15BN bailout plan for Greece.

The Eurozone finally agreed agreed to bailout Greece via three year loans at 5%, less than the real market rates.

Ironically even those countries that are also close to financial ruin (Spain, Ireland and Portugal) are being forced to contribute to help Greece.

It is now down to Greece to draw down the loans, and for individual member states not to veto the loan agreement.

This is of course only a temporary respite. The "rescue" package merely increases Greece's debt, and puts off the day when the country pas to pay the price for it misfeasance.

The real world solution is for Greece to exit the Euro and allow its currency to collapse.

Be under no illusions, Greece will be forced out of the Euro.

The Eurozone finally agreed agreed to bailout Greece via three year loans at 5%, less than the real market rates.

Ironically even those countries that are also close to financial ruin (Spain, Ireland and Portugal) are being forced to contribute to help Greece.

It is now down to Greece to draw down the loans, and for individual member states not to veto the loan agreement.

This is of course only a temporary respite. The "rescue" package merely increases Greece's debt, and puts off the day when the country pas to pay the price for it misfeasance.

The real world solution is for Greece to exit the Euro and allow its currency to collapse.

Be under no illusions, Greece will be forced out of the Euro.

Friday, April 09, 2010

Greece Stands On The Edge

Greece is now standing on the edge of a financial precipice, pushed there by ever rising borrowing costs.

The rise in borrowing costs forced the European Central Bank (ECB) to prolong its easing of the rules on using government bonds as collateral for its loans.

The problem stems from the fact that the Greek government has not indicated exactly what it needs/wants to resolve its problems, ie it has to go publicly to the IMF and EU and ask for help.

This of course will not play well domestically. It therefore should not come as any surprise to learn that Greece is steadfastly sticking its head in the sand, and saying that the aid is not yet needed.

The reality is of course that the markets will do the equivalent to Greece what they did to the UK in the early 90's (when the UK was pushed out of the ERM); Greece will, if it does not act swiftly and decisively, be pushed out of the Euro.

The other problem facing Greece is that, even if it does publicly ask for help, the EU and IMF have yet to finalise the structure/terms whereby aid would be given.

In short Greece will be pushed out of the Euro, it is only a matter of time.

The rise in borrowing costs forced the European Central Bank (ECB) to prolong its easing of the rules on using government bonds as collateral for its loans.

The problem stems from the fact that the Greek government has not indicated exactly what it needs/wants to resolve its problems, ie it has to go publicly to the IMF and EU and ask for help.

This of course will not play well domestically. It therefore should not come as any surprise to learn that Greece is steadfastly sticking its head in the sand, and saying that the aid is not yet needed.

The reality is of course that the markets will do the equivalent to Greece what they did to the UK in the early 90's (when the UK was pushed out of the ERM); Greece will, if it does not act swiftly and decisively, be pushed out of the Euro.

The other problem facing Greece is that, even if it does publicly ask for help, the EU and IMF have yet to finalise the structure/terms whereby aid would be given.

In short Greece will be pushed out of the Euro, it is only a matter of time.

Thursday, April 08, 2010

Euro 40BN Claim Against Kaupthing Bank

Wikileaks reports that 28167 claims, totalling over 40 billion euro, have been lodged against the failed Icelandic bank Kaupthing Bank hf.

Wednesday, April 07, 2010

Greece Stands At The Precipice

As predicted, despite the recent paltry IMF/EU "rescue" deal, Greece is determined to be the author of its own destruction.

Greece's borrowing costs rose yesterday, as markets tested the sincerity of Greece and the rescue package itself.

Rumours abound that Greece has little or no intention of complying with the austerity measures enforced upon it by the rescue package, and that it is in fact trying to renegotiate the package.

Greece has of course denied that it is in a renegotiation. It knows full well that any admission of such a renegotiation would push it over the precipice.

Aside from Greece's sincerity over rebuilding its shattered economy, the markets are also questioning the exact terms and conditions of the package.

Germany wants any deal done on commercial rates. However, other member states are prepared to offer sub market rates. Until the EU sorts its own position out, the package itself cannot actually be implemented.

Once Greece falls, as it looks likely to before the summer, other weak economies (aka "PIGS") will also fall:

- Portugal

- Ireland

- Greece

- Spain

As I have noted before, the solution for the EU is to kick Greece out of the Euro before the markets force it and the other PIGS out.

Greece's borrowing costs rose yesterday, as markets tested the sincerity of Greece and the rescue package itself.

Rumours abound that Greece has little or no intention of complying with the austerity measures enforced upon it by the rescue package, and that it is in fact trying to renegotiate the package.

Greece has of course denied that it is in a renegotiation. It knows full well that any admission of such a renegotiation would push it over the precipice.

Aside from Greece's sincerity over rebuilding its shattered economy, the markets are also questioning the exact terms and conditions of the package.

Germany wants any deal done on commercial rates. However, other member states are prepared to offer sub market rates. Until the EU sorts its own position out, the package itself cannot actually be implemented.

Once Greece falls, as it looks likely to before the summer, other weak economies (aka "PIGS") will also fall:

- Portugal

- Ireland

- Greece

- Spain

As I have noted before, the solution for the EU is to kick Greece out of the Euro before the markets force it and the other PIGS out.

Tuesday, April 06, 2010

Public Sector Pensions

With a general election looming the CBI have entered the political fray and, quite correctly, pointed out that someone really needs to do something about public sector pensions.

The CBI state that the public sector final salary pension schemes (a burden of around £1 Trillion) are unsustainable and must be overhauled.

The CBI state that public sector pension benefits are now worth an average of 26% of annual salary, this is far beyond the norm in the private sector.

The CBI wants the next government to set up an independent commission to fully investigate pension costs.

All very well.

However, the politicians have a vested interest in retaining the current system, as when they retire they receive a public sector pension.

The CBI state that the public sector final salary pension schemes (a burden of around £1 Trillion) are unsustainable and must be overhauled.

The CBI state that public sector pension benefits are now worth an average of 26% of annual salary, this is far beyond the norm in the private sector.

The CBI wants the next government to set up an independent commission to fully investigate pension costs.

All very well.

However, the politicians have a vested interest in retaining the current system, as when they retire they receive a public sector pension.

Thursday, April 01, 2010

No More Boom and Bust?

Those of you with long memories may recall some years ago the then Chancellor, Gordon Brown, boasting in parliament that there would be "no return to boom and bust".

However, politicians' promises are as fleeting as the early morning dew. Following on the from the worst recession in decades, the CIPS/Markit manufacturing purchasing managers' index (PMI) rose to 57.2 in March (from 56.5 in February). This is the highest level since October 1994.

Additionally, the Post Office is set to offer "super sized" mortgages to people with only a 10% deposit; thus hoping to end the loan drought that has held back the housing market.

However, those of you who fear a boom should take comfort in the fact that the TUC has promised months of industrial unrest. This will guarantee that any boom will be short lived, as the "brothers" seek to push the economy back into the economic doldrums.

In retrospect maybe Brown was right, there will be no return to boom and bust; we seem to be condemned to live in a permanent state of "bust".

However, politicians' promises are as fleeting as the early morning dew. Following on the from the worst recession in decades, the CIPS/Markit manufacturing purchasing managers' index (PMI) rose to 57.2 in March (from 56.5 in February). This is the highest level since October 1994.

Additionally, the Post Office is set to offer "super sized" mortgages to people with only a 10% deposit; thus hoping to end the loan drought that has held back the housing market.

However, those of you who fear a boom should take comfort in the fact that the TUC has promised months of industrial unrest. This will guarantee that any boom will be short lived, as the "brothers" seek to push the economy back into the economic doldrums.

In retrospect maybe Brown was right, there will be no return to boom and bust; we seem to be condemned to live in a permanent state of "bust".

Subscribe to:

Posts (Atom)